[ORIGINALLY POSTED in February 2017 at http://www.dennis.co.nz/2017/02/24-bbx-uk-membership-analysis/index.html]

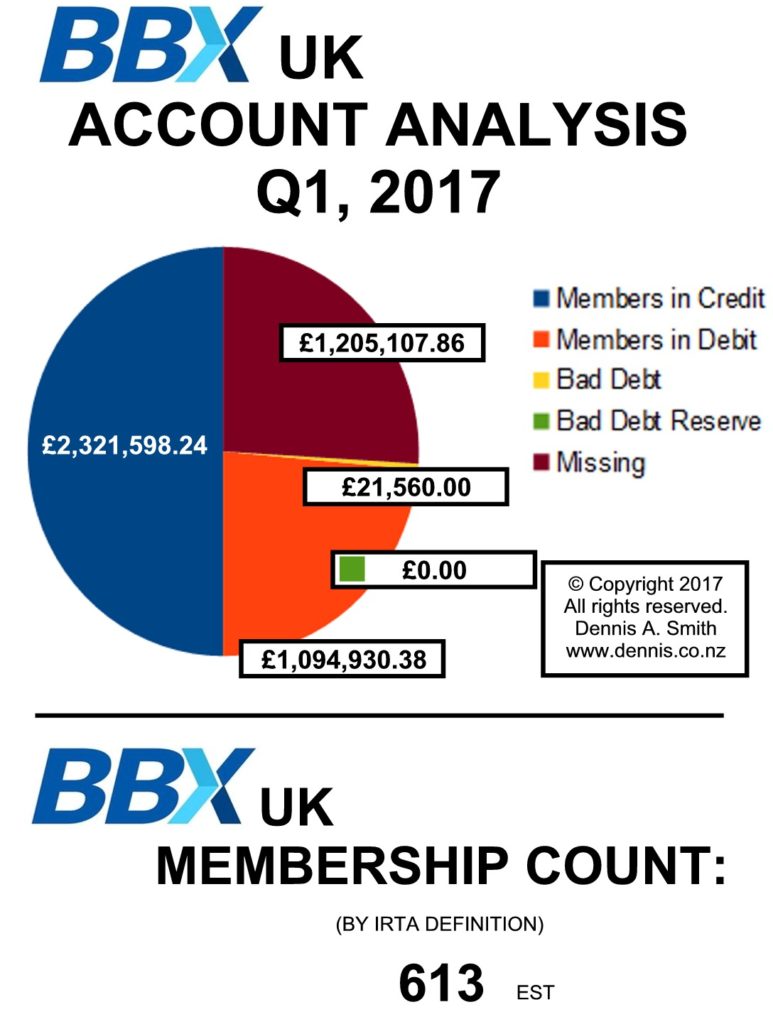

Here are the statistics for BBX UK, based on actual membership data. BBX UK is the healthiest of all the BBX exchanges in the sense that there are members trading, equal numbers of members in debt and credit but claimed membership numbers are grossly exaggerated and there are substantial missing balances (over £1.2m), which is quite unusual for a young exchange. I detail the figures and give my prognosis . . . somebody’s had their hands in the cookie jar!

BBX UK is a relatively new BBX Franchise, apparently (according to BBX’ own marketing materials) racing onwards to 5,000 members. It’s not. It’s a young and growing exchange barely operational for a couple of years. Trading really only started in earnest in 2015/2016.

While there are several points to note, there are two glaring anomalies with the BBX UK figures – the very large (relation to the current balances) value of missing transactions and the huge number of dormant members.

High Numbers of Dead Members

The typical phases of a regular Barter exchange is that growth up to 300 members is hard work and takes time. Mum, Dad and the family dog can usually get a barter exchange up in running with the magical 300x members in a couple of years. After those numbers it usually requires good systems with staff, administration, sales, brokering and this requires substantial effort.

John Attridge established BBX UK having ‘bought’ the UK Master license from BBX Founder Michael Touma, and he has taken the exchange up to 3324 members in the database. As shown by the feedback from BBX members contacted, not all of them knew that they were members; not all of them even knew BBX and some had asked to be removed from the database yet still remained. BBX UK’s marketing misrepresents reality and by a large margin.

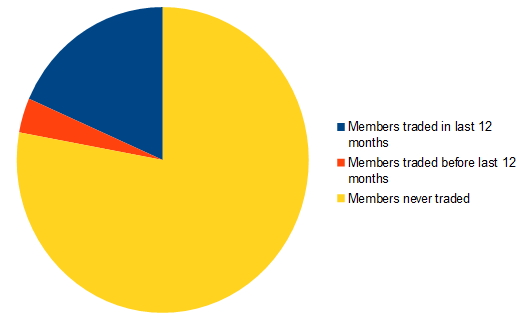

There are a total of 3324 members in the database.

Of this 735 have traded, 613 have traded in the last 12 months (this is IRTA’s rule) and 122 have traded but not in the last 12 months.

That makes 2589, or 77.89% who have never traded. These are people who have sniffed around the edges; signed up under pressure; been signed up without their knowledge; signed up and cancelled but not take off the system or similar.

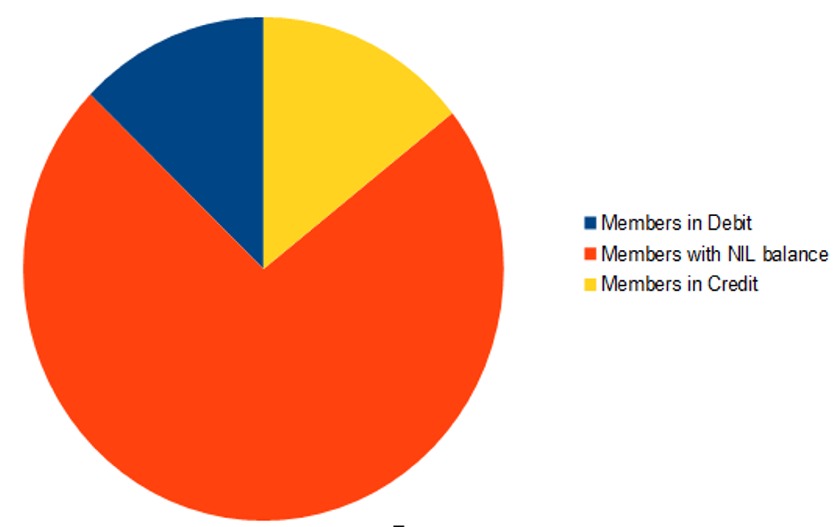

Analysis by numbers of members on balances shows a similar story, with member numbers in debit and members in credit roughly equal, and a huge red area on the graph – NIL balances.

Of note is the missing Bad Debt Reserve – there is none and quite small bad debts, certainly no obvious large ones typical of an older exchange . I have included bad debts of £21,560.00 being the sum of debtors all with the same or similar amount. This is a best guess but may be valid Member debts to the system and at the end of the day is still a small proportion of the final figures.

The raw figures used for the top right chart are:

Total Members 3324

Members in Debit 426

Members with NIL balance 2,420

Members in Credit 478

Analysis of members in credit shows a spread typical of a trading exchange. Here are the values of members with BBX credits exceeding £1ok:

87,603.77

60,220.00

46,108.25

32,579.53

25,065.42

24,323.40

22,353.05

21,889.38

21,658.41

20,840.40

17,006.23

16,417.88

15,936.00

15,296.02

14,171.10

13,735.40

12,524.51

12,099.60

11,409.86

10,543.78

10,078.99

Here are the balances of the BBX UK members over £20k:

20,022.81

20,745.82

22,799.44

23,232.17

24,448.05

24,558.35

25,386.82

25,718.49

25,966.77

30,892.75

34,569.68

47,892.68

54,362.50

61,232.50

73,908.00

178,571.38

218,287.29

224,832.00

The Missing Million Quid

Now to the biggie . . . there’s a huge problem with the BBX UK accounts.

There’s a shortfall of £1.2m. Members owe the system £1,094,930.38 but the members are OWED more than twice that – £2,321,598.24 to be precise! Whew! Now that’s inflation with a capital “I”!

In a properly accounted for barter trade exchange any transaction has an equal and opposite transaction on the other side of the ledger. If one person sells £100.00 of goods into the system, then someone else will have a debt to the system – easy! If over time there have been losses, then sure, we can expect to see a Bad Debt figure in the accounts. Over the years this may grow a little and the currency takes a bit or members contribute in to clear the bad debt out (this is what a Bad Debt Reserve is for after all). But with no Bad Debt Reserve and huge discrepancy this looks very like theft, plain and simple.

So, not to be one to shoot out wild claims lightly, I checked and rechecked my figures – always the same . . . something is missing and it’s always £1.2m. Now this is not only a relatively large figure (nobody normally walks around with a million quid in their back pocket) but it is from a young exchange with a very small percentage of members actually trading. There appears to be no large account balances, like the BBX Australian ones (you can see the analysis above with figures all around the same, which represents typical accounts for an SME business exchange), so what gives?

I’ve put this challenge here before. . . try to run a business which actually loses money and it’s hard to do it legitimately especially when you get into the millions. What’s more, these member accounts are simply missing balances! Even a missing balance of £1.oo should never occur!

I don’t know yet what’s up at the BBX UK headquarters but it seems to me that value has been sucked out of the exchange deliberately and very quickly. To have £1.2m gone from the accounts in only a few short years does NOT bode well for the exchange. With the figures showing value in the ledger at £1,094,930.38 members owing but missing £3,548,266.10 the currency is already deflated to 31c in the £.

This will mean that some people cannot find things or people to trade with and (unless there is a huge influx of new blood, new products and services entered into the system), it will naturally devalue even further and finally go into gridlock. The only way to avoid this is to repay into the system value that has been taken out. Don’t expect that to occur in a hurry though!

John and his team have a lot of questions to answer in my book, for having an unbalanced ledger is a RED ALERT for any forensic accountant, and Her Majesty’s’ Assistants may be very curious as to who was doing property deals with the BBX UK Members’ credits and where the real value ended up!

John Attridge has been working with a lot of Bartercard boys . . . I notice that the founder of Bartercard is trading in the BBX system. Ex-Bartercard people are highly skilled in concealing debt. They know the tricks of the trade and play the game hard. Looks like BBX UK is going down the exact same tracks as Bartercard has been, sadly this sort of business conduct always ends in tears.

My prognosis – not good.

Very not good and tears, inevitable.

The BBX Investigation Series

- PUBLIC WARNING: BBX Barter (2381 words)

- 2. War Erupts Within BBX Barter (4090 words)

- 3. BBX is Busted – Working it Out (2388 words)

- 4. BBX has big, Big, BIG Problems (1778 words)

- 5. The Demise of BBX (3489 words)

- 6. BBX – A Summary (1308 words)

- 7. Reflections on Investigating BBX (6394 words)

- 8. BBX – The First Criminal Charges (3625 words)

- 9. BBX Crimes – The Significance (2,710 words)

- 10. BBX Causes Problems for IRTA (2,251 words)

- 11. BBX: Rats Off a Sinking Ship (1,715 words)

- 12. BBX Data Security Breach (1,852 words)

- 13. BBX Threatens – Sue Me PLEASE! (1,511 words)

- 14 The BBX Knives Are Coming Out (1,791 words)

- 15. BBX Memberships – Names in a Database (2,774 words)

- 16. BBX UK & The Franchise Show (2,840 words)

- 17. OPEN LETTER 1 – BBX Members (162 words)

- 18. BBX Currency Analysis – 10c/$1.00 (1,527 words)

- 19. The BBX People Speak (11,726 words)

- 20. More Words from BBX People (15,206 words)

- 21. How BBX Did It – Lies & Theft (3,663 words)

- 22. BBX – Winding Down/Winding Up (3,217 words)

- 23. BBX New Zealand Analysis (828 words)

- 24. BBX UK Membership Analysis (1,143 words)

- 25. BBX NZ – Serious Fraud Office (1,261 words)

- 26. BBX – Thailand Member Analysis (1,165 words)

- 27. BBX Minor Countries Analysis (574 words)

- 28. The BBX People (2,290 words)

- 29. BBX International in a Nutshell (295 words)

- 30. The Raw BBX Data (4,463 words)

- 31. BBX Members React – It’s War (5,617 words)

- 32. BBX and Issues of Morality (1,363 words)

- 33. Warning to BBX Staff & Associates (1,944 words)

- 34. BBX Devaluation Helps With Tax Losses (1,269 words)

- 35. BBX Rips Open the Barter Industry (1,237 words)

- 36. MEDIA RELEASE: Barter Tax Avoidance Warning (516 words)

- 37. BBX Whistleblower: Cameron McKean (4,994 words)

- 38. The BBX Investigation Final Comments (1,504 words)

Leave a Reply