This post is the first in what will likely be a series of posts developing the book Inland Revenue UNMASKED!!. I intend to share my experiences dealing with what they call the IRS (Inland Revenue Service) in the States, HMRC (Her Majesties Revenue & Customs) in the UK, ATO (Australian Tax Office) in Australia and the IRD (inland Revenue Department) in New Zealand. It will expose individuals because I will be naming names, but as always I speak only truth and any person referred to has full right of reply. Enjoy.

While established yonks ago, New Zealand’s taxation ran as the IRD from 1952 then in 1995 as simply “Inland Revenue” although those older still refer to it as IRD. The current Commissioner is female thus it is normal within IRD circles to refer to the Commissioner as the CIR, she and her. The IRD’s internal coding practice refers to a taxpayer as a tp as well as other abbreviations.

On 14 March 2022, I agreed to meet with the CIR’s representatives and did so by phone. Having learned stuff from previous engagements with the IRD, I agreed to meet conditional on the meeting:

- Being “on the record”;

- Recorded by myself and the CIR (their response to mine);

- That I would have the first opportunity to speak;

- That I would exercise respect and proper decorum, and

- Provide a written copy of my grievances to the IRD in writing prior to the meeting.

I also asked for the investigator’s supervisor to be present. They also wanted me to agree to avoid personal attacks which I consistently informed them that if airing grievances involved naming names then I would do so, albeit of course in a respectful manner. The IRD tried to alter their agreement so that they could prevent me naming names and dealing with real people and their failures but told them and they agreed that I could/would read my statement FIRST, that the statement would be on the record and recorded. I also put it in writing prior to the meeting thus I publish my statement here BY AGREEMENT.

This document details ten grievances I have with the IRD. Rather than simply a laundry list of events adverse to my interests, I have included a point of two of learning at the conclusion of each grievance. I think sharing my experiences and learning from them puts my current words and actions into proper context. It will inflame those with an agenda but placate those who are honest and seek to resolve any dispute.

The CIR’s position is that Writing the Wrong has not conducted a taxable activity and thus is denied the right to pay GST. If you’re thinking that this is all nuts, that a man has to fight the taxman (actually a woman) for the right to pay tax is crazy, then join the crowd. You’re not alone thinking that you’re in the Land of Oz. Alice will be along shortly I am sure!

I have provided information confirming that my company Writing the Wrong Ltd has conducted a taxable activity to the current date, the core issue in dispute. My PDF supplied to IRD this morning prior to the meeting can be viewed here. As will be seen, I do not trust the current people dealing with my tax affairs. I claim that there is and has been a personal agenda and conduct containing a considerable degree of deception and dishonesty from the outset of their investigation, several years in fact.

The Communication

14 March 2022

IRD Grievances – Summarised

- c1980 – DENNIS ARTHUR SMITH

In my early 20s, in or about 1980 I returned a tax return and claimed expenses as a trainee teacher. I filed my tax return accurately, on time and provided all my genuine receipts. The IRD arbitrarily determined that only half of my rebate would be repaid, which it was. The CIR’s assessment was that despite having the evidence to the contrary, the proportion of my taxable expenditure of gross income fell outside of IRD norms.

From this I learned that the CIR had more power than me and that his interest in legal compliance and fact was less than mine. - 1992 – TENZL

In 1992 I established Team Electronics Ltd and sold it in 1994 with a NIL Balance Sheet resulting. It had $3-4k in PAYE & GST owing for the last current trading period. No arrears existed. The buyers agreed to pay it as part of their S&P Agreement but they didn’t. Upon their bankruptcy, IRD sued my company for this plus penalty interest. I offered to pay IRD the $3-4k personally but they rejected my offer and chose to wind up the company instead receiving nothing. The High Court Judge told me that while the IRD’s conduct may look crazy to the rest of us, the courts could not overturn the CIR’s ruling.

From this I learned that reality is different from the ideal and that the IRD cannot be trusted to work in the countries best interest. - 2009 – TTT

In 2009 I sold up and emmigrated to Samoa. At the time The Thornton Trust had a $99k tax credit as a result of selling a property it had owned and rented for more than 20 years. The IRD’s approach was that it was “just too bad” that I lost all the trust records when I was ‘removed’ from Samoa in 2015 thus TTT lost a $99k tax credit.

From this I learned that sh*t happens and that the IRD could and would take, but not give. - 2016 – GO GO GO SAMOA

In 2016 I established Go Go Go Samoa Ltd and intended to take my Samoan family around New Zealand on a working/promotional tour. They chose to stay in Samoa so I renamed the company Writing the Wrong Ltd and proceeded to build a house-truck to run a mobile recording studio among other things. I registered as a Licensed Private Investigator, developed our marketing materials and prepared the business for a taxable activity but IRD’s subsequent investigation determined that I was not conducting a taxable activity. A TRA hearing supported the CIR’s views with the Judiciary using falsehood, twisting or ignoring facts & common sense.

From this I learned that when the CIR wishes to ‘get’ one she can be assured that the Judiciary can or will help her. - 2007 – DAVID WELSH

In Q1 2017 following an SFO rejection, I, along with my aging father met with David Welsh, Grad Dip Arts (Crim) I Dip Pol I CFE, Investigations & Advice Team Leader, Inland Revenue at 15 Tanekaha Rd Titirangi to advise IRD of a tax fraud of 498 New Zealand entities totalling a minimum of $690m but likely more. I had the evidence. He advised that IRD was not interested (it had too many other cases) and when challenged with the illegality inherent, David advised us in the presence of another IRD witness that “crimes were committed every day”.

From this I learned that the IRD was more interested in presenting themselves in a positive light than actually seeking to enforce the law. - 2018 – CROWN LAW

In a previous meeting with IRD, investigator Alexey Anohkin commenced his verbal presentation ‘on the back foot’ explaining why his secret research (which I had found and proved by way of an OIA request) was not actually used in forming the CIR’s opinion. I did not believe him and told him that, so when contronted and he then insisted that this was so, I advised him that I would hold him to that assurance if it ever came to court. Crown Law did indeed try to use that error in his finding as evidence against me in court, contrary to his strong and repeated assurance otherwise.

From this I learned that nothing spoken or agreed with the IRD, even in a meeting ON THE RECORD with the IRD could be trusted. - 2018 – LINDA DZAFERIC

At that same meeting I listened as Linda Dzaferic, Alexey’s immediate supervisor sat directly opposite me at a table but lied to my face as I had established to my satisfaction that the IRD staff had discussed the matters of the meeting with the facilitator prior to my arrival despite their assurance otherwise and that there was no mention of a subject she raised as an excuse in the file notes.

From this I learned that some of IRD’s representatives had no compunction to deceive if they felt they could get away with it. - 2018 – MARYANNE HANSEN

After I obtained a copy of my IRD file using the OIA, I established that my complaints had been consciously covered up by the very person that I had complained about. Upon lodging a formal complaint with her Group Team leader, I ‘casually’ dropped into the conversation that my upcoming book “Inland Revenue UNMASKED!!” would have a beautiful high resolution colour photograph of the named individual on the cover – as a person whom I saw as showing the world “the face of corruption”. Within two days of that private conversation, the individual in question removed the photo off multiple variations of her Facebook pages and she deleted her entire LinkedIn profile, a series of acts deliberately designed to prevent the public knowing her identity and role within IRD.

From this I learned how a piece of information potentially devastating to the reputation of the IRD was more important to senior people within the IRD than integrity. - 2016 to Current – CORRUPTION & SELF INTEREST

Over the years relating to this matter I have watched with interest as three or four CIR investigators (Robert, Alexey and others), their supervisor (Linda Dzaferic), her supervisor (MaryAnne Hansen), Crown Law (ultimately, Oscar Upperton) then the Judiciary (AA Sinclair J) dealt with the matters I raised. I have observed ample dishonesty, corruption and self-interest within the IRD.

From this have come to expect bias from the CIR. - Current – MEETING ATTENDEES

It is my belief that:

a) All the attendees know the identity of the current investigator’s supervisor;

b) They also know that this has deliberately not been revealed to me, the tp;

c) They know why it has been withheld; and

d) The reason for two of their attendances is because of that identity.

- RESULT

I do not therefore trust the IRD as an organisation due to the dishonesty of specific individuals who have shown and continue to demonstrate to me bias, along with excessive self-interest.

It is my claim that the CIR’s position that the tp is not conducting a taxable activity is wrong, that her position and conduct has contained and still contains impropriety by way of a personal agenda and bias, conduct that has and continues to seriously disadvantaged [sic] the tp.

END

Dennis A. Smith

Private Investigative Blogger

Taumarunui

57hq (Book March 2021)

dbj3 (FB March 2021)

8shv (Post March 2022)

Summary

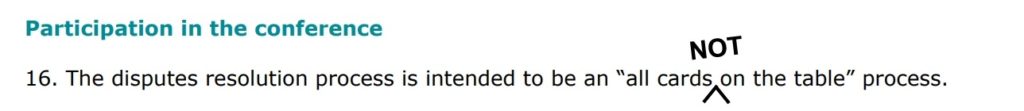

The meeting was arranged, agreed (PDF), recorded (MP3 of the first section of the conference) and “on the record”. We adjourned for me to think through what I wanted. On our return I made it clear that I did not seek anything from the CIR that admitted liability but that I did seek approval that the dispute process was reasonable. They agreed to that – apparently a dispute process is a formal and normal thing for them. Putting the matter out to another person or team however was a problem to these people whom I came not to trust. Despite their claims to the contrary, i.e. that it would be an “all cards on the table” meeting – it certainly wasn’t!

I have only known two people within the IRD I can or could trust – one was terminated because he was too detailed an auditor, and the other, a woman who in the short time I dealt with her seemed to lack ego, have a brain and she used it.

Our meeting finished without agreement because the people who controlled it refused to answer one simple question: “Did you know prior to the meeting who the investigator’s supervisor was? Yes or no?” Gary Swain, the legal man tried to obfuscate by asking why he should agree to answering it, then claiming that it was irrelevant, then he just downright refused to answer it. Alan Telford, the ‘boss-man’ Team Leader also refused to answer the question, so . . . End of conversation (MP3 of the last section of the conference). They knew all right – they knew and that they knew proves to most of the rest of us that they knew that there would likely be trouble! They knew not only who they were covering for (as did I) but they also knew the exposure of the BS that they were covering up for – which is why they tried to protect her in the first place. As they say, you only get the flak when you’re over the target!

Anyone dealing with the Tax Taker is wise to take the above into consideration and to understand that you as the tp are a target. Take it all or you will buy a fight with individuals who have a lot of power. You know what they say about this don’t you? Power corrupts.

In future posts I will be sharing the specifics of how the people in power exercise it. Refusing to answer a simple question is only the tip of the iceberg! Get your popcorn ready people now that the IRD has agreed to speak on the record and has agreed to let me put my grievances out there!

You fail to point out that you’re not trying to PAY GST, you’re trying to get GST refunds by claiming that eventually “writing the wrong” will have taxable activities, thus anything purchased now will give you a refund for the GST portion.

The rejection was perfectly normal. You never quite reveal the full story of what you’re doing. That’s normal for a criminal like yourself.

Just confess you were trying to get a GST REFUND and be honest.

Thank you for bothering to make comment here Wilkes but your aggression is foolish and you falsely accuse. Do some basic due diligence and you can see that I am not driven to criminal activity. Sure, like all humans I have the capacity for self-interest and greed but I choose to play it straight. You ascribe immorality where none exists.

Yes, of course I was (and am) seeking a refund of GST! ‘Refund’ means that you get back what has already been paid does it not? You know like actually already paid to the government? Wilkes, this is normal business practice! Anyone experienced in business will know this. The question up for grabs is not whether there is GST already paid due back to me, the question is whether or not WTW is (or intended) to conduct a taxable activity. My contention is that it is and always has been its intent. Five years of trading should be sufficient proof should it not?

You’ve traded 5+ years without a declared profit, and sought GST refunds consistently. If every individual could register a shell company with no obligation to actually trade commercially, and then claim back GST, then the purpose of end-user Goods and Service tax would be nil.

That you don’t like us and claim that taxation is somehow immoral is aside from the point. The law is for everyone. Not just for those who believe it applies to them. You are not above the law.

The audit discovered that your income tax returns were fraudulent because:

1. You were not in business for the purposes of paying income tax.

2. The expenditures you claimed GST refunds for were private in nature and they did not contribute to the creation of a taxable activity within a reasonable period.

3. No taxable activities existed for the periods that you claimed GST refunds.

You have asserted throughout your post that you were trying to register for GST to pay tax. The opposite is true. You were trying to obtain a GST refund to which you were not entitled. Please stick to the facts. Nowhere do you mention your huge GST refund demands in this entire post.

I’ll give you more time over the weekend and address the issues you raise here more over the weekend Wilkes but there are some things that you clearly do not understand – the law for one. business for another and thirdly, me, and in your line you really should know better.

Get your popcorn ready folks!